Covered has partnered with Total Expert to embed homeowners insurance technology directly into Total Expert Journeys, simplifying homeowners insurance for borrowers and lenders, throughout the borrower relationship.

Request a Demo

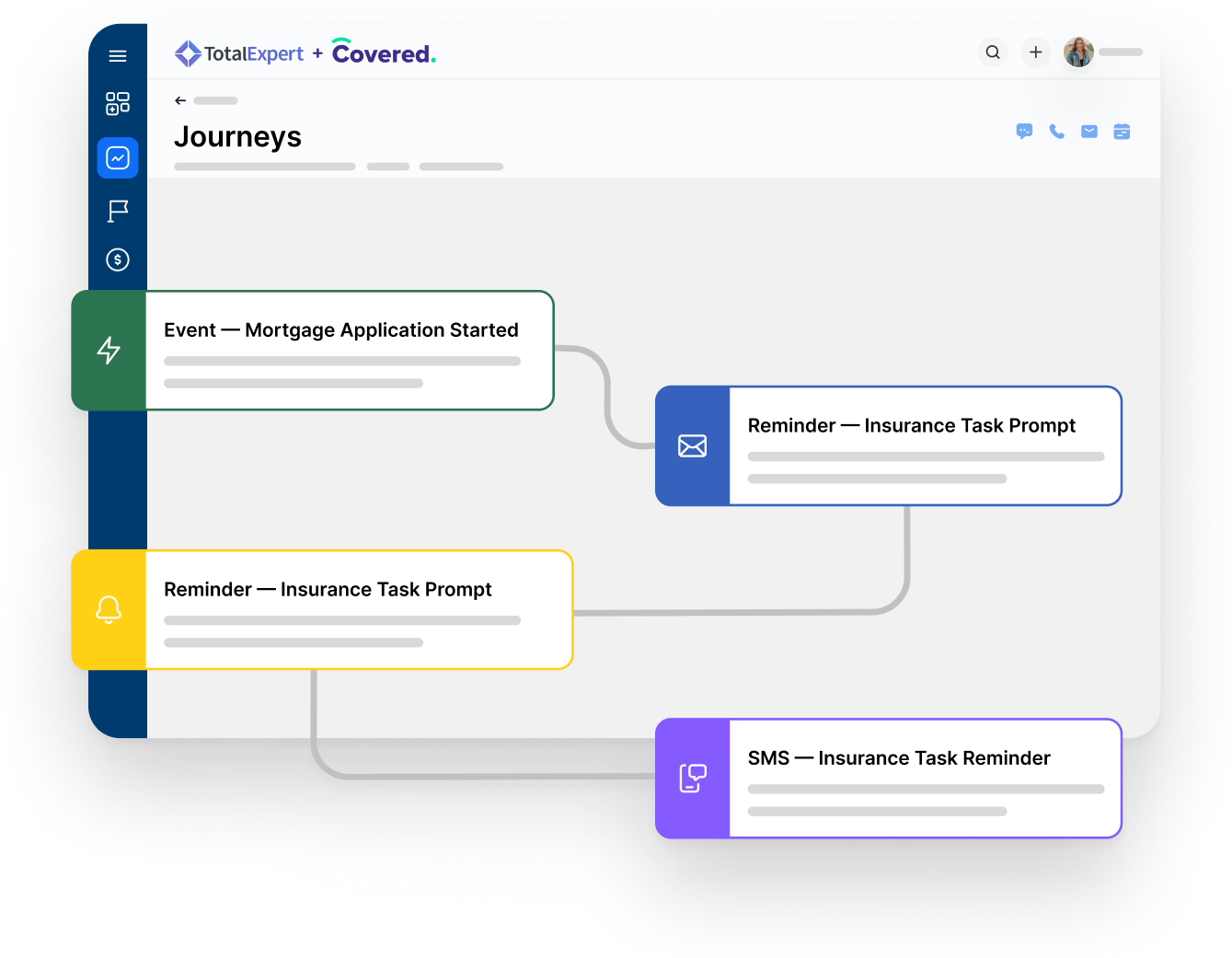

Covered’s integration with Total Expert enables lenders to deliver insurance prompts inside their existing marketing Journeys, helping borrowers take action at the right moment while minimizing HOI-related delays and manual work for lenders.

%20copy.avif)

%20copy.avif)

.svg)

Utilize ready-made Total Expert Journeys supporting the insurance task, crafted by mortgage marketing leaders at Covered and Total Expert

.svg)

Add ready-made insurance emails to existing Total Expert campaigns, prompting borrowers at key lifecycle moments

.svg)

Get real-time HOI updates when borrowers purchase insurance through Covered

.svg)

Offer excellent insurance support to their borrowers, while reducing insurance-related workload for lenders

Make it easy for borrowers to access mortgage-ready coverage that keeps pipelines moving

%20copy.avif)

%20copy.avif)

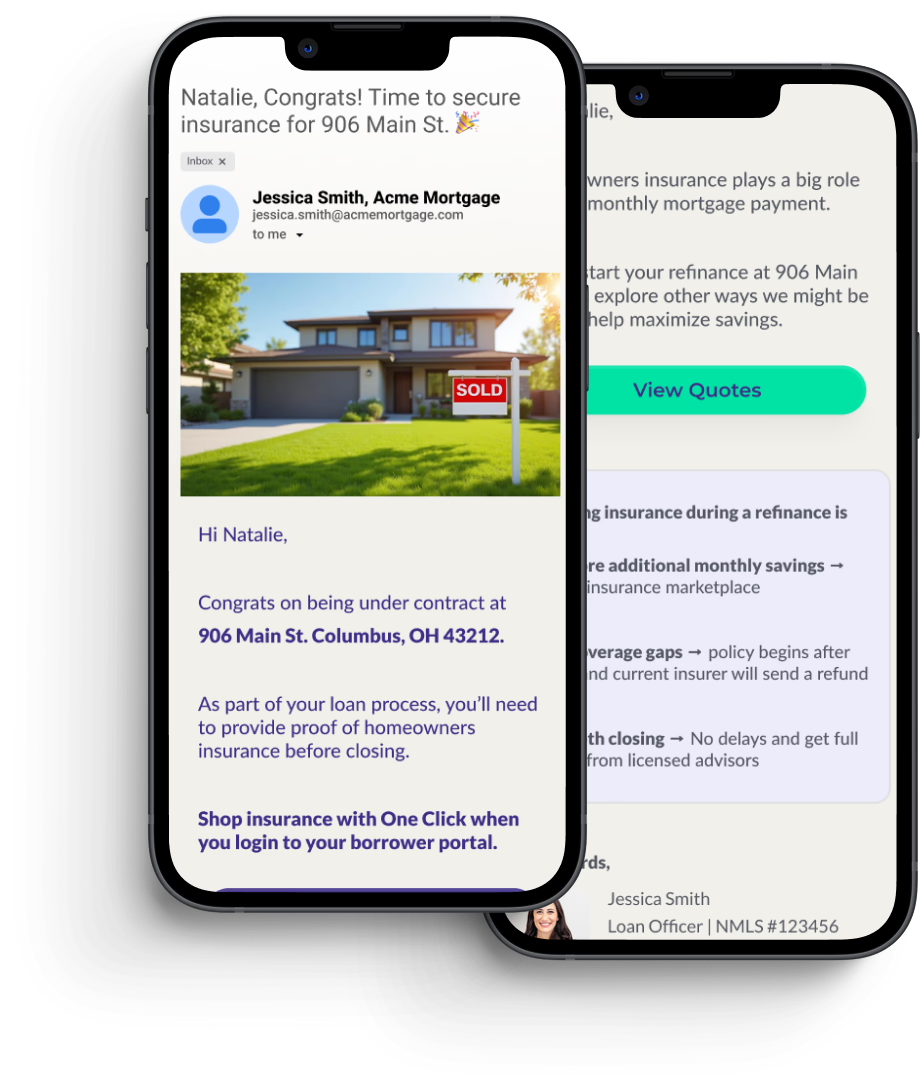

Shop for mortgage-ready coverage with one click, directly from Total Expert emails in their inbox

Avoid long forms just to shop quotes—borrower data from Total Expert is pre-filled into the Covered quoting experience, making policy shopping fast and easy

Navigate HOI affordability and availability challenges with support from Covered’s mortgage-trained insurance advisors

.svg)

Shop for homeowner's insurance (along with auto, flood, umbrella and more)—directly from Total Expert Journey emails

Save at renewal or other key borrower touch points with proactive reminders

Borrowers already have a lot on their plate. Total Expert + Covered delivers insurance prompts at exactly the right time—and gives borrowers an easier path to reviewing, comparing, and securing homeowner’s insurance coverage.

.svg)

One-click insurance shopping embedded directly into Total Expert Journeys

.svg)

Access to competitive, mortgage-ready HOI quotes from a carrier marketplace spanning 50 states and access to 65+ top-rated carriers

.svg)

Expert guidance from mortgage-trained insurance agents, helping borrowers secure coverage quickly and confidently

.svg)

Savings opportunities at renewal, helping borrowers avoid payment shock or costly insurance lapses

.svg)

Step-by-step guidance from Covered’s insurance experts, throughout all journeys of their loan

Don’t let homeowners insurance keep your loans from closing. Covered can help LOs avoid HOI-related closing issues, while minimizing time spent chasing evidence of insurance.

.svg)

Reduce administrative work by automating EOI collection and documentation

.svg)

Avoid last-minute coverage issues by prompting borrowers to find mortgage-ready coverage early in the process

.svg)

Deliver a more delightful borrower experience when it comes to homeowners insurance

.svg)

Strengthen your relationships by offering borrowers affordability and insurance availability solutions throughout the life of the loan

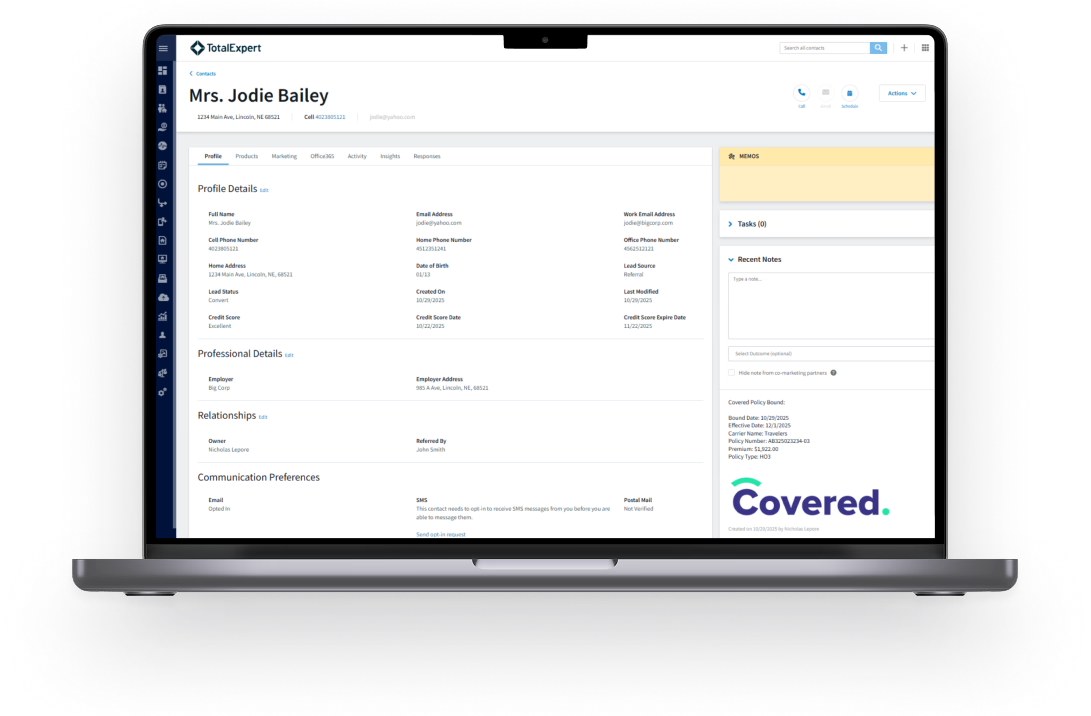

Covered’s Total Expert integration supports mortgage efficiency from origination to refinancing and servicing—reducing borrower friction and supporting lender outcomes.

%20copy.avif)

.svg)

Reduced fallout: Minimize closing delays by offering coverage options designed to align with mortgage requirements.

.svg)

Reduced time spent on insurance: Embedded insurance workflows, expert borrower support, automated EOI uploads, and pre-filled lender-specific mortgagee clauses reduce rework and insurance-related delays.

.svg)

Improved borrower experience & satisfaction: A consistent, high-quality insurance experience for your borrowers that reflects well on your institution. Covered has an excellent 4.7 star rating on TrustPilot, based on 885 reviews.

.svg)

Improved servicing KPIs: Minimize inbound calls related to escrow shock and force-placed insurance by proactively offering savings opportunities via insurance.

.svg)

Accelerate closings with actionable insurance, automate insurance collection, and keep loans on track.

.svg)

Insurance education and awareness

.svg)

Shop insurance with one click—simplify the borrower experience

.svg)

Insurance task awareness within the POS

.svg)

Loan anniversaries: Extend value post transaction

.svg)

Simplify insurance renewal shopping and deflect escrow “shock” from call centers.

.svg)

Automate insurance renewal campaigns

.svg)

Escrow shortage or payment increase: Provide proactive saving opportunities with insurance shopping

.svg)

Loan boarding: Extend value on day 1 with Covered’s Insurance Checkup

.svg)

Coverage lapse: Simplify shopping insurance

.svg)

Reduce total monthly payments, retain more borrowers with savings value, and provide better insurance visibility for LOs.

.svg)

Shop insurance with one click—simplify borrower experience to explore savings

.svg)

HELOCs: Extend value to make sure borrower has the right coverage

.svg)

Offer your borrowers a new savings lever via insurance

Not all carrier networks are created equal. We've curated a list of 65+ top-rated national and regional carriers specifically chosen for mortgage workflows—helping your borrowers find coverage, even in complex risk scenarios.

.svg)

.svg)

See how you can turn insurance headaches into new opportunities.

%20copy.avif)