Pet Insurance Affiliate Programs for Financial Institutions

Pet insurance affiliate programs allow financial institutions to expand their service offerings while generating new revenue streams through integrated insurance marketplaces. These programs enable banks, credit unions, and fintech companies to provide pet protection options while maintaining their existing customer relationships. Through modern integration methods, high-quality financial services seamlessly incorporate pet insurance into their product lineup without developing insurance products internally.

Seamlessly integrating into your existing workflow, our digital insurance marketplace allows your customers to compare insurance quotes from a variety of A-rated carriers.

Understanding Pet Insurance Integration Models

Modern insurance marketplaces provide multiple ways for financial institutions to connect with pet insurance carriers. Each integration method offers distinct advantages based on the institution's goals, technical capabilities, and customer needs. These flexible solutions allow financial partners to choose the approach that best fits their specific requirements.

White Label Solutions

White-label pet insurance programs maintain financial institution branding throughout the entire customer experience. From quote pages to policy documents and customer-centric communications, the insurance offering appears as a natural extension of the institution's services. This experience keeps customers within the financial institution's ecosystem while they shop for, purchase, and manage their pet insurance policies.

Value Added Services

Pet insurance programs strengthen customer relationships by providing protection for an important part of their lives. This additional touchpoint increases customer engagement and creates natural opportunities for discussing other financial services. Regular policy reviews and claims support build trust and reinforce the financial institution's role as a complete financial services provider.

Customer Lifetime Value Enhancement

Insurance offerings help deepen banking relationships by addressing more aspects of customers' financial lives. When customers manage their pet insurance through their primary financial institution, they're more likely to maintain their accounts and explore additional services. The data gathered through insurance interactions helps financial institutions better understand and serve their customers' needs.

Partner with

Get a Demo

Implementation and Support Process

Successful pet insurance policy programs require careful planning and ongoing support to maximize value for both the financial institution and its customers. The implementation process follows proven steps to establish smooth integration and minimal disruption to existing services. Support systems help maintain program quality and address any issues that arise.

Technical Integration Process

Implementing a pet insurance program requires careful planning and execution. Each step builds toward a successful program launch. Follow these five helpful implementation phases:

- Platform Configuration: Set up systems, customize interfaces, and establish data connections.

- Brand Customization: Align insurance materials with financial institution branding and standards.

- Staff Training: Prepare team members to discuss and support pet insurance offerings.

- Compliance Review: Ensure all materials and processes meet regulatory requirements.

- Marketing Setup: Deploy approved marketing materials and launch customer communications.

These steps create a foundation for long-term program success and scalability. Regular review and optimization of each component confirm that the program continues to meet both institutional goals and customer needs.

Ongoing Program Management

Regular performance reviews track important metrics and identify opportunities for optimization. Customer feedback shapes program improvements and helps refine the user experience. Marketing campaigns adapt to changing customer needs and market conditions while aligning compliance with insurance regulations.

Pet Insurance Product Features

Pet insurance products through financial institutions offer robust protection options that address common customer concerns. These products combine traditional insurance features with modern digital tools to create a user-friendly experience. The product design focuses on clarity and value while maintaining flexibility to meet diverse customer needs.

Coverage Types and Options

Standard accident and illness coverage forms the foundation of pet insurance offerings. Wellness plans can be added to cover routine care and preventive treatments. Additional options include coverage for hereditary conditions, behavioral therapy, and alternative treatments, allowing customers to build plans that match their pets' specific needs.

Marketing and Customer Education

Financial institutions play an important role in helping customers understand the value of pet insurance protection. Educational resources complement marketing efforts to create informed customers who make confident insurance decisions. Clear communication helps build trust and increases program participation.

Strategic Integration Points

Pet insurance policy programs integrate naturally with existing financial services touchpoints. Digital banking platforms showcase insurance options when they're most relevant to customers. Branch staff and customer service representatives receive training to discuss insurance options and direct customers to additional resources.

Educational Resource Development

Educational materials explain insurance concepts in clear, accessible language that resonates with customers. Content addresses common questions about coverage, claims, and costs while highlighting the benefits of obtaining insurance through a trusted financial partner. Resources include both digital and printed materials to reach customers through their preferred channels.

Technology Platform Capabilities

Advanced technology platforms power modern pet insurance programs while maintaining security and reliability. These systems handle complex insurance processes while presenting a simple interface to customers. Integration with existing banking technology creates a unified experience across all services.

Quote Generation and Comparison

Real-time pricing engines compare options from multiple carriers to find appropriate coverage. Policy customization tools help customers adjust coverage levels and deductibles to match their needs and budget. The platform maintains accurate pricing and availability information through automated updates from carrier partners.

Service Integration Systems

Customer support systems connect seamlessly with existing banking service channels. Support staff have access to complete policy information to assist customers efficiently. Integration between insurance and banking systems allows for quick resolution of billing and coverage questions.

Program Performance Optimization

Pet insurance programs require regular monitoring and adjustment to maintain peak performance. Data-driven insights help financial institutions refine their offerings and improve customer engagement. Success metrics provide clear direction for program improvements while identifying areas for growth.

Analytics and Reporting

Data analytics tools track key performance indicators across multiple program aspects. Monthly reports show policy sales trends, customer engagement levels, and revenue generation patterns. This information helps financial institutions understand customer behavior and adjust their strategies accordingly.

Success Metrics

Measuring program effectiveness requires tracking specific performance indicators. Regular monitoring of these metrics helps optimize pet insurance affiliate programs. Here are five important measurements that indicate program success:

- Policy Conversion Rates: Measures the percentage of quotes that convert to active policies.

- Customer Retention Rates: Monitors revenue potential and customer coverage selections.

- Cross-Sell Ratios: Evaluate success in connecting pet insurance with other financial products.

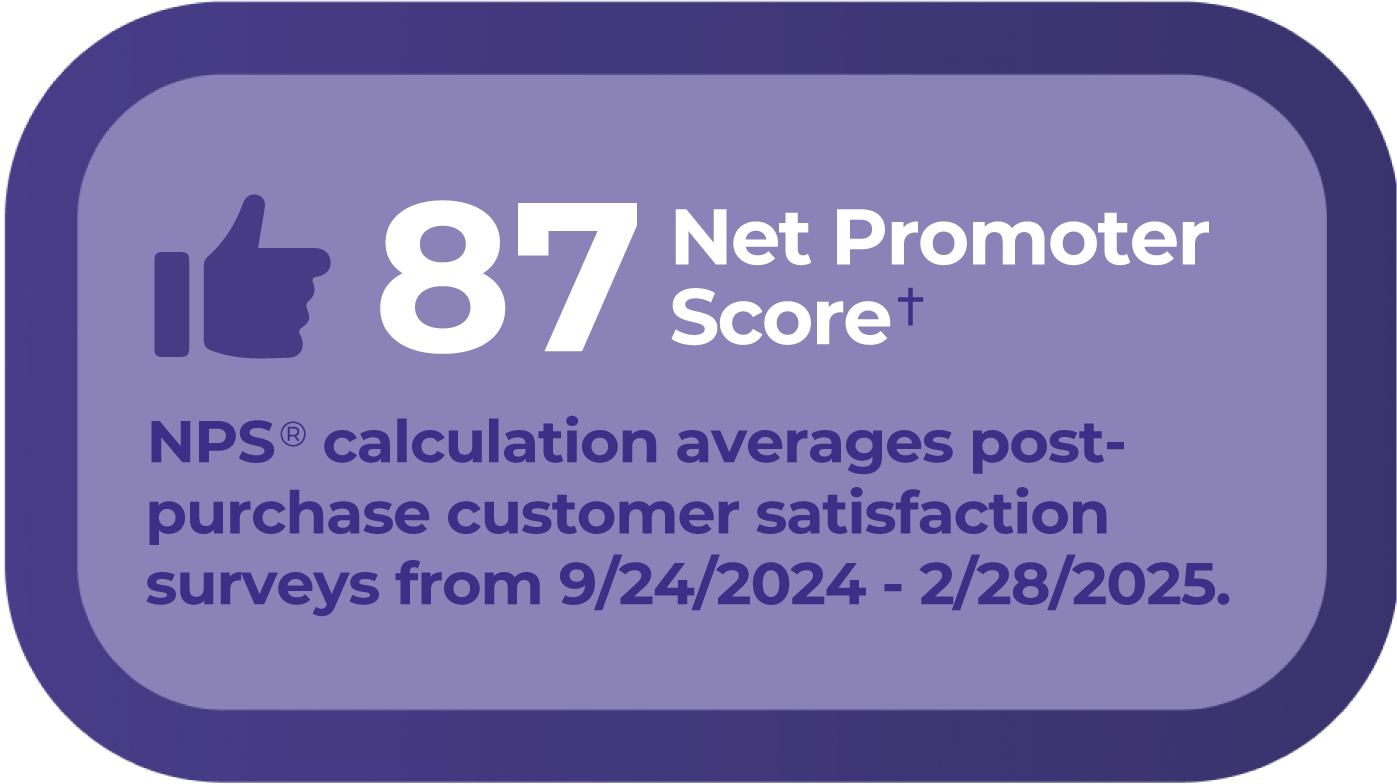

- Customer Satisfaction Scores: Gauges overall program effectiveness and service quality.

Regular analysis of these metrics guides program improvements and helps identify areas needing attention. Strong performance across these indicators suggests a healthy, growing program that delivers value to both the institution and its customers.

Quality insurance coming from trusted brands

Multi-Product Integration Strategy

Pet insurance works most effectively as part of a broader insurance offering within financial platforms. Strategic integration with other insurance products creates natural cross-selling opportunities and increases overall program value. Financial institutions can use existing customer relationships to introduce pet insurance at relevant moments.

Cross-Selling Opportunities

Pet insurance policy discussions often arise naturally during conversations about property insurance or life changes. Financial advisors can introduce pet protection options while reviewing customers' overall financial wellness plans. Multi-policy discounts provide additional incentives for customers to consolidate their insurance needs through their trusted financial institutions.

Customer Journey Integration

Strategic placement of pet insurance information throughout the pet parents' journey increases program visibility and adoption. Digital banking platforms can highlight pet insurance options based on customer life events or spending patterns. Mobile apps provide easy access to quotes and policy information alongside other financial services.

About Covered: Your Pet Insurance Affiliate Partner

FAQs

An insurance affiliate program is a partnership between financial institutions and insurance providers that allows the institution to offer insurance products to their customers. These programs typically integrate easily with existing financial services platforms, enabling a more comprehensive suite of offerings. Through these programs, financial partners can earn commissions on policies sold without having to develop or underwrite insurance products themselves. This arrangement benefits both the financial institution and its customers by providing access to valuable insurance options within a trusted ecosystem.

Pet insurance coverage for vaccines varies depending on the specific policy and provider. Many standard pet insurance plans focus on unexpected illnesses and injuries and may not include routine care such as vaccinations. Some providers also offer wellness plans or preventive care add-ons that can cover vaccines and other routine procedures. When integrating pet insurance options, financial partners should consider offering a range of plans to meet diverse customer needs. It's important for customers to review policy details carefully to understand what is and isn't covered.

Pet insurance affiliate programs create new revenue streams for financial partners through commissions on policies sold. They enhance customer loyalty by providing a valuable service that addresses a significant concern for pet owners. These programs also position financial partners as comprehensive solution providers, potentially attracting new customers seeking holistic financial services. Offering pet insurance can also increase customer touchpoints, leading to more opportunities for cross-selling and upselling other financial products.